Training : What Is A Sales Budget? (And How To Prepare One)

What Is A Sales Budget? (And How To Prepare One)

A sales budget is a critical element in any business. It’s hard to understand how much money you’ll make without a budget. And it’s even more challenging to plan when you don’t know your income. This guide will help you understand what goes into a sales budget and any other aspect you may want to learn about this type of financial plan.

What Is a Sales Budget?

Well, one way we define it is it provides an estimate of the volume of goods and services that a company proposes to sell in a future period. It is usually made for the following year. Most sales budgets include monthly and quarterly figures as well. Additionally, the budget provides details in both monetary figures and in units.

A company accesses data from various sources when it prepares a sales budget for the next year. How does a company get the information it requires to make its budget? Knowing this will help you develop a sales proposition in line with its future.

First, the company will look at its sales from the previous year – most firms try to exceed last year’s sales figures. This can be done by selling more to the same customers or by looking at new markets. A company could also try to increase its sales by launching new products.

Secondly, it uses future estimates for how well they think the company can perform in the next few months. These ideas can give a realistic figure for the sales expected in the next year.

Naturally, the company must consider any changes that are happening in the near future. Are they planning to expand their operation or cut back? Is the market planned to get larger or contract? Bearing these in mind can have a big impact on the way the company is looking at the future budgets it will lead with.

So, the planning of a sales budget provides details of the amount of money that a firm estimates it will receive from the sales of its goods and services in a particular period. That helps you to help the buyers to plan for the next few months or years, with your solutions proving a main assist in achieving their goals.

Sales budgeting, therefore, is to plan for and control expenditure of resources (money, material, facilities, and people) necessary to achieve the company’s desired sales objectives. It aims at leveraging and maximising profits.

Each different department within the company you would be working with usually demands additional funds and so there could be deviation from any agreed sales budget. There should, of course, be scope for deviations in sales budgets, as they are agreed at the time of development.

Why Are Sales Budgets Important?

A sales budget is important because it allows you to plan your income and expenditure. It gives you an idea of how much money you’ll make in the future and what areas you may need to cut back on if needed.

These are the reasons why you need a sales budget:

1. Improves Cash Flow Management

When you have a sales budget, it’s easier to keep track of your cash flow. You can see how much money is coming in and going out so that you can make better financial decisions for your business.

This is especially important if your business is seasonal. When you know what months will be busier than others, you can plan for it and make sure you have the cash flow to cover your expenses.

2. Helps You Determine Overhead Costs

It’s important to know your overhead costs when creating a budget. These are the expenses that come up every month, such as rent and utilities.

Knowing how much these will be each month for the next year is vital in making sure you have enough money to cover them each time they come around.

You also need to factor in the cost of payroll and your other wages. This is important to know because you can’t afford to pay these people if there’s no money coming in from sales.

Once you have this information, you can determine how much income needs to come in each month for the business’s survival.

3. Establish Business Strategies

A sales budget is also effective at establishing proper business strategies. For example, you can figure out how much money to invest in marketing if your income isn’t coming in as fast as expected.

This may mean that you need to try a different form of advertising or find ways to make more customers patronize your store for the current fiscal year.

4. Easily Get Loans

A sales budget can also help improve your credit score. By showing that you’re able to manage your finances well, you may be able to get a loan with better terms or at a lower interest rate.

This is important if you need to expand your business or buy new equipment.

5. Predict Sales

If you’re interested in knowing how your sales will be for the next year, a sales budget is best to get this information.

Once you have all your numbers and figures together, make predictions on what income may look like based on historical data of previous years’ earnings.

This can help give you an idea of whether or not you can afford to expand your business or if it’s best to stay the way you are.

7. Attract Investors

Investors want to know if your business will be successful in the future.

By showing them a sales budget, you can give potential investors an idea of how much money they’ll make if they invest in your company and help prove that it’s worth their time and money.

What Is Included Within a Sales Budget?

Now that you know why a sales budget is important, it’s time to learn what goes into this financial plan.

1. Expenses

It’s essential to include any expenses that you’ll incur during the year in your budget. This includes all the money you’re going to spend in a year. And you can break this into categories, such as marketing, payroll, and rent.

Ensure you include advertisement costs and how much you’re going to spend on different marketing strategies.

It’s also important to include the cost of paying your employees, such as wages or salary.

The easiest way is by using a percentage that represents your business’ gross income after expenses and then dividing this into equal portions for each employee throughout the year.

Another expense category you may include is any money you’ll invest in your business. This could be the cost of buying new equipment or updating old products to make them more efficient and profitable.

You need to know all these expenses so that if income doesn’t meet expectations, it will still allow the company some wiggle room for survival.

Finally, don’t forget to include things like rent and utilities. You can expect these expenses each month, so it’s important to know how much they will be throughout the year.

It’s important to track these expenses each month so that you know how much money you’re spending and where it’s going. This will help you stay within your budget.

2. Sales Forecasts

One of the most important aspects of a sales budget is your sales forecast. This is where you predict how much money you’ll make in the future.

To do this, you’ll need to know two numbers: how many sales per day and the average sale amount.

You can use historical data or just your best guess for these estimates.

Once you have that information together, plug it into a spreadsheet program like Microsoft Excel or your CRM or accountancy software so that the formula is automatically calculated when saved. This will give you a sales forecast for each month.

This information is important because it will help you make decisions on whether or not to expand your business, hire new employees, and so forth.

You can also use this data to find out how much money you need to bring in each month to meet your financial goals.

3. Total Revenue

Along with your expenses and sales forecasts, you’ll also need to include the total revenue that comes into the business. This is how much money will come in from all sources.

And it includes money earned from products or services and any investments you make in the company.

It’s important to know where all your business’ money is coming from so that you can plan for it and budget for it. You may also want to track this number each month to see how your revenue changes over time.

4. Price Per Unit

Knowing the price per unit is essential for setting sales goals. This number tells you how much money you’ll make on each item that’s sold.

You can find this information by looking at your cost of goods sold and multiplying it by selling. That will give you your profit margin for each product.

By knowing your price per unit, you can set sales goals that will help increase your revenue stream.

When creating a sales budget, it’s important to remember these four aspects so you can have a successful year for your business.

How to Prepare a Sales Budget

Now that you understand the basics of a sales budget, you may want to prepare this financial planning document.

1. Select a Period

The first step is to select the time you want to create a budget. That can be for the current year or future years.

It’s important to remember that your sales budget should be updated each month as your business’ income and expenses change.

So, if you’re creating a budget for the current year, you’ll need to update it each month.

2. Gather All the Information You Need

To create a sales budget, you’ll need to gather some information. That includes your company’s income and expenses for the past year or projected numbers for the future.

Don’t forget to mention the equipment cost.

Also, don’t forget about things like rent and utilities. You can expect these expenses each month. So, it’s essential to know how much they will be throughout the year.

You’ll also need to know how many products or services you plan to sell each day and the average sale amount.

3. Benchmark from the Industry (Market Trends)

One of the best ways to set a sales budget is by looking at market trends. This will give you an idea of how much money you’ll need to bring in each month to stay afloat.

You can also use this information when forecasting future income and expenses.

It’s important to remember that not all businesses are equal. So, make sure you benchmark yourself against businesses in the same industry as you.

You can find this information online or by contacting your local chamber of commerce.

4. Consider the Size of Your Sales Team

When creating a sales budget, you’ll also need to consider the size of your sales team.

If you have a small sales team, you can expect to bring in less money each month. However, if you have a large sales team, you can expect to make more money.

That’s important to consider when forecasting your expenses for the future. Having many sales reps may indicate that you’ll need to increase your budget for marketing and advertising. It also shows that you may make plenty of sales.

5. Talk to Your Sales and Customer Reps

You’ll want to talk with your sales reps and customer service representatives. Ask them what they think is the best budget for your business moving forward.

These employees know how much money you need each month to run smoothly. So, it would help to know their opinion when determining a monthly amount to allocate.

It’s also a good idea to have your sales reps discuss their average sale. That will indicate how much money they can bring in each month on average throughout the year.

6. Talk to Your Customers

Talking to your customers is another way to determine how much money you should plan for each month.

Your sales reps may make an average of $500 in monthly income. But they probably only sell 10 per day on average. So, that’s just half of what it would take if all your team sold the same amount every single day with no variation.

You’ll also want to determine how much your customers are willing to spend on average. This can help you set a limit for each product or service you sell.

7. Create a Budget

Now that you have all the information, it’s time to create a budget.

You’ll want to start by estimating how much money your business will make in total for the year. This is done by multiplying your average sale amount times the number of products or services you plan on selling each day.

Then, subtract your expenses from this number. This will give you the amount of money you’ll have leftover each month.

You can then divide this by 30 to get your daily budget allowance. Or, if you want to be more precise, you can break it down even further and figure out how much money you should plan on spending each hour.

8. Review Your Budget Monthly

It’s important to review your budget monthly and make changes as needed.

This will help ensure that you are on track to reach your goals and that no unexpected expenses pop up.

If something comes up that wasn’t accounted for, then you can adjust your budget as necessary. But don’t forget that things like rent, utilities, and payroll will always need to be paid.

Remember that this is just an estimate for future income and expenses. So, it’s not likely to go exactly as planned.

But if you stay on top of it and make changes as needed, then you should have a good idea of how much money your company can expect to earn each month going forward.

Examples of a Sales Budget

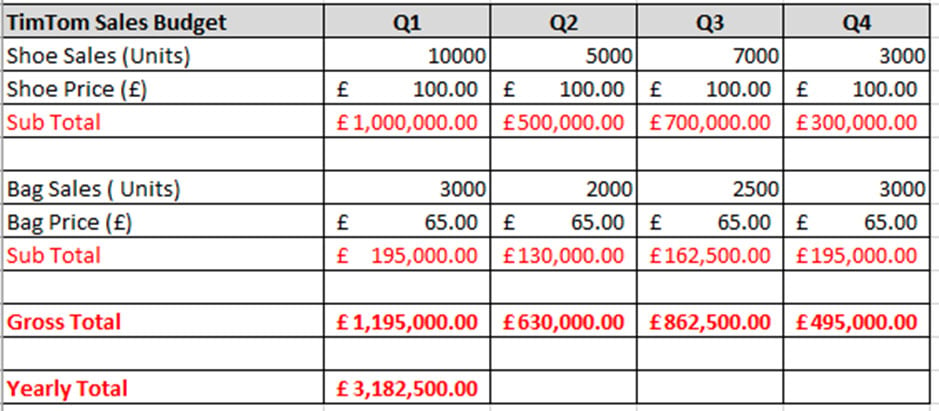

Here’s an example of a simple sales budget.

TimTom sells 10,000 pairs of shoes at £100 per unit in the first quarter. The company can expect a sales budget of £1,000,000 after the first quarter.

[£100 x 10,000 units= £1,000,000].

If the company sells an additional 5,000 units in the second quarter and another 7,000 units in the third quarter, the sales budget will be £2,200,000.

[£100 x 22,000 units= £2,200,000].

Working with a sales budget template can make the process much easier. A template will provide you with a framework to work within, ensuring that all necessary components are included.

The Bottom Line

A sales budget is vital for all businesses, regardless of size or industry. It helps you track your progress and stay on target with your goals.

Creating a sales budget can seem daunting, but it’s well worth the effort. With the right tools and information, it’s easy to create a sales budget that works for your business.

Make your exam here :